Challenging the Status Quo to Take the Sting Out of Your Fuel Budgeting Woes

Budgets!

Who needs ‘em?

Well, unfortunately, we all do. They are a necessary element in our day-to-day operations.

The mere existence of a budget is not all bad. But, if unforeseen challenges arise that are outside of your control, which create conflict with the goal of meeting your budget, then budgets can quickly become a necessary evil.

Top of the List of Flight Ops Challenges

In a recent study, the Small Flight Department Subcommittee of the National Business Aviation Association (NBAA) surveyed approximately 200 operators, and found that the number one challenge staring them in the face was budgeting.

Budgeting for your fixed expenses is essentially a non-starter.

But the operational costs create potential for time stealing frustration, just to ‘balance the books’ for each flight.

With fuel costs far outweighing other variable expenses, this element of your daily operations can become quite challenging.

And, with scheduled maintenance costs, and flight crew expenses thrown into the mix, even they are virtually more predictable than your fuel costs.

With the volatile cost of fuel changing on a daily basis due to the price of crude oil fluctuations, it is nearly impossible to predict what your fuel costs will be on any given upcoming flight. This is increasingly difficult the further into the future your flights are scheduled.

And, with the current tensions in the Middle East, one wonders what is going to happen to those prices in the near term. Not only does the price across the board change daily, but the costs across your market area vary quite widely on the same day.

Within the United States, according to Global Aviation Navigator at GlobalAir.com (at the time of this writing), Jet-A across the eight regions of the lower 49, with Hawaii included in Western/Pacific Region, ranged from $4.88 per gallon to $5.54 per gallon. That is a microcosm swing of 13.52%.

Add Alaska, at $6.35 per gallon, and that calculates a variation of 30.12%.

Now, on a macro scale, the oil price spikes. Wow! What a negative effect on your fuel budgeting they create.

Crude Oil Price History

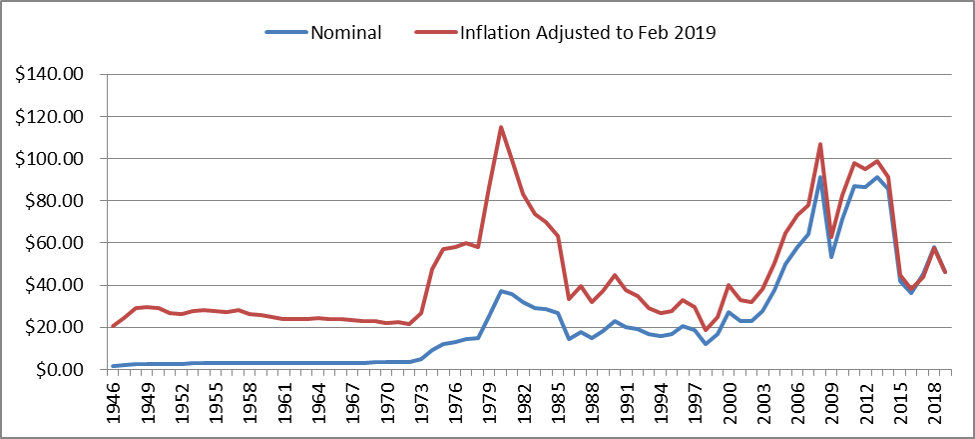

Of course, the ever changing cost of oil is a certainty. Currently, we are by no means near our historical high. But, we don’t have to be, to have even a small increase in oil prices to create a detrimental effect on your operations.

Here is a graph showing the historical price of a barrel of crude since 1946, along with the inflation adjusted price up through February 2019:

Currently, we see ourselves in a relative reprieve. But, no matter the cost of oil, you still have to minimize your fuel costs on all of your flights. Taking things into account such as fuel costs at all stops, landing fees, to tanker or not, and more.

These calculations take substantial time to complete, and with a minor error in calculation, a noticeable change to the make-or-break status of your fuel budget will show. Is there a way that you can increase the efficiency, and accuracy, of these critical calculations?

Something different than what you may be doing right now?

The Challenge

There is a story told over the years that illustrates how, that if we are not careful, we can be lulled to sleep by doing the things the way we always have done them. We keep doing these because, quite frankly they work. Or, at least did at one time. And, with the daily grind of keeping your operations going, it can be challenging to find the time to look for even the possibility of existing options.

The story goes something like this:

There was a little girl helping her mother prepare the evening family meal. The primary course was a roast.

As the mother removed the meat from the refrigerator, she cut off a small section from each end, tossed the severed pieces into the trash, and then placed the remainder into the casserole dish.

The little girl asked, “Mommy, why do you cut the ends off the meat?”

Her mother replied, “Well, that is the way my mother taught me. But, I’ll ask her.”

At the earliest possible time, mother asked grandma the same question.

Grandma replied, “Because it wouldn’t fit into the pan.”

A Bigger Pan

Is there a ‘bigger pan’, a new tool, to help you maximize the savings on your fuel consumption costs? Maybe now, with the oil prices relatively low, would be the time to answer that question.

Surely there must be a different way, a more efficient way.

Technology changes with the times. And, even the times change with technology.

The Ever Present Constant … Change

Take the music industry.

For in-home enjoyment of music, we can look at the development of the 78 rpm record. That then evolved to the 45, then the 33, the 8-track tape.

Ahhh, the 8-track. You know, the one where, even to this day, you might still hear in your head a tune from your favorite tape, which would volume down to zero - click click - as the track changes, then your song volumes up again.

After that, the cassette tape, the CD, and finally streaming.

With every advancement came increasing capacity, in most cases on smaller and smaller platforms, at ever-increasing quality and efficiency. And we went from contact to contactless transfer of data.

The ancestors of the current method of creating written documents include, rock and wood carvings, quill and ink; where if one wanted copies of a document, they had to be hand-written each time. Then came the printing press, with arduous typesetting; each and every letter, space, numeral, jot and tittle, laid into place by hand, being viewed upside-down and backwards.

The same with mathematics. The evolution steps of calculating include, among others, the abacus, slide rule, and the handheld calculator. Again, advancing capacity, speed, and accuracy by multiple factors.

Now, we find that all three of these industries have been virtually replaced by the current state of the evolution of the computer age.

And, with the internet evolving just in the last decade or so to the point where massive amounts of data can be sent, and extracted, from across the world near instantly, our ability to operate our endeavors has opened up vast capability to function most efficiently.

Removing That Sting

With fuel costs creating a double hit on your budgeting, there is a new tool, that larger pan, which has come along to smooth out your fuel planning difficulties.

Now you can reduce waste and stop tossing those ‘ends of the roast’, those extra costs of time and money, into the trash.

Meet FuelerLinx, the most accurate fuel planning and tankering software in business aviation.

FuelerLinx is so simple to use, because it is so advanced. The software and computer perform the multiple mundane calculations for you.

- The program allows you to

- Optimize Flight Operations

- Automate Fuel Purchasing

- Reduce Operating Costs in One Easy to Manage Application.

FuelerLinx has helped hundreds of flight departments save time and money by automating the critical and laborious manual aspects of fuel management budgeting.

Since its beginning FuelerLinx has added multiple features that helped save their customers’ valuable time and money.

Features such as:

- Fuel Planning

- Dispatch

- Tankering

- Flight Planning

- Reporting

- Analytics

- Software Integrations

- Mobile Accessible

Here is what some of FuelerLinx customers had to say:

As a result of using FuelerLinx we have been able to produce a more efficient procedure not only for planning the logistics of each trip but the quoting process, and accounting process have also improved. I have found our entire experience with FuelerLinx to be an asset to our company.

Mark Palmer, President

X8 Aviation LLC

FuelerLinx not only helps us decide the best fuel price, but the best overall FBO experience... they’ve gone above and beyond being a simple “fuel app”. FuelerLinx... allows us to save time on multiple levels of the trip... While it may be possible to measure the dollars and cents we save on fuel with FuelerLinx, it is more invaluable of the amount of time we save as a department from start to finish with each trip thanks to their help.

Matthew Sorace, Charter Coordinator/Maintenance Controller

Cutter Aviation

FuelerLinx is amazing! It paid for itself in the first month for my entire year subscription. The multi-leg tankering calculator saves me valuable time and shows me cost savings instantly. Then the software allows me to keep track of my savings and automatically populate charts to make fuel spend analysis a breeze. Can't recommend them highly enough.

Kyle Burnett, Chief Pilot & Aviation Manager

Dynamic Healthcare Solutions

Request Your Free Demo

Contact SC AeroTech to schedule your free demo today, and begin to bite back at your fuel budgeting challenges.

(213) 268 1482

info@sc-aerotech.com

SC AeroTech is the leading research and advisory firm focused exclusively on business aviation. As emerging technologies and software platforms unlock some of the biggest value pools for growth opportunities and operational improvements, our clients turn to us for the indispensable insights, advice and tools, that can provide them with the competitive advantage of tomorrow. Our mission is to equip aviation leaders across the globe to make the right decisions and stay ahead of change.

Pilot Shortage and Low Salaries: Long hours, high demand, high stress, high responsibilities.

Nobody wants to be a pilot anymore. As the airlines tell it, a so-called pilot shortage has made it impossible to staff their fleets, forcing them to cancel flights and park hundreds of airworthy planes in the desert. One airline ventured to blame its 2016 bankruptcy on its inability to hire enough pilots, and even at always-profitable and carefree Southwest Airlines, the challenge of recruiting millennial aviators keeps middle management awake at night. “The biggest problem,” a Southwest executive told Bloomberg, “is a general lack of interest in folks pursuing this as a career anymore.”

Airline execs tend to make the shortage seem more mysterious than it is, as if something in the contrails is fueling this “general lack of interest” in the profession. That’s evasive. Rather, the shortage is best understood as an obvious manifestation—and perhaps the nadir—of a long-term de-professionalization of what was once a solidly middle-class career: We made the pilot occupation so unattractive, so tenuous and poorly paid, that people stopped wanting to do it.

Flying, meanwhile, has also become unbearable for passengers. The airlines that survived the volatile decade following 9/11 have since consolidated themselves into a lucrative oligopoly, prompting questions about why smaller cities continue to lose service, why seats keep getting smaller, why fares have remained stubbornly high even as fuel prices dropped and profits soared, and why paying passengers are being quasi-defenestrated from overbooked flights.

The degenerating passenger and pilot experiences aren’t separate phenomena but in fact are intimately related, both resulting from policy choices that have propelled a decades-long, ongoing makeover of the national air-transit system. The difference, perhaps, is that we are more conscious that we, the passengers, are getting a raw deal.

So are aviation workers, but there is more to the pilot shortage than just pay. Industry representatives are pushing Congress to address the rising cost of pilot training, which can exceed $100,000 after requirements became more stringent in response to a 2009 crash. Competition for pilots has also gone global, causing many young pilots to leave the U.S. to chase more exotic opportunities with Emirates and other Middle Eastern carriers. And there are class-conscious obstacles to recruitment—flying has become less glamorous.

But at the regional airlines where the effects of the pilot shortage are most acute, even management seems to have finally acknowledged that pay matters, as evidenced by their recent efforts to raise starting salaries that paid first-year pilots as little as $15,000 to $20,000. And although many jobs have gotten worse in the past few decades, pilot wage stagnation distinguishes itself in several respects.

First, airline jobs appear to be caught in a steeper free fall. Before President Carter and a Democratic Congress deregulated the airlines in 1978, few industries paid higher wages. In the 1990s, a number of studies reviewed deregulation’s impact on airline wages, attributing decreases in the range of 10 to 20 percent for pilots, and more for flight attendants. While many observers hypothesized that wages would stabilize as the shakeout from deregulation attenuated, wages never managed to find a floor in the decade after 9/11. According to a Government Accountability Office analysis, pilots’ median weekly earnings fell another 9.5 percent from 2000 through 2012—lower wage growth than 74 percent of the other professions included in the GAO’s review.

Nor has this wage erosion been limited to pilots. Today, many flight attendants begin their careers making less than minimum wage. It’s even worse for those who work outside the aircraft. Average weekly wages for airport operations workers, a category that includes baggage handlers and other support staff, fell by 14 percent from 1991 to 2011—a growth rate that was lower even than the low-wage retail and food service industries, according to a 2013 study. Airline workers also work much harder than they did in the past; the industry had the second highest multifactor productivity growth from 1997 through 2014, according to an analysis by the Bureau of Labor Statistics.

Declining wages and inequality are sometimes described as an inevitable, deterministic outcome of abstract economic forces, but none of the usual suspects seem to adequately explain what’s happening to airline jobs in the U.S.—not immigration (pilots and flight attendants must speak English), globalization (so-called cabotage laws have limited the scope of international outsourcing), automation (robots haven’t yet displaced pilots), or the decline of unions (union density remains high). How, then, could the airline industry have fared worse than most other industries?

In the recent history of pilot wages, two related trends have tipped the balance of power between the airlines and their labor force: the proliferation of outsourcing strategies after 9/11 and the consolidation of the country’s major air carriers.

Regional airlines are having the hardest time hiring pilots. These companies, where most pilots now begin their careers, operate almost half of all domestic flights on behalf of major carriers like Delta, United, and American. David Dao was actually kicked off a United flight that was operated by Republic Airways. Though the employees on the plane wore United uniforms, their paycheck came from Republic.

The regional industry grew as a strategic response to the downturn after the Sept. 11 terrorism attacks. The airlines’ losses were unprecedented. Through 2005, the airlines lost more than $50 billion and received more than $5 billion in direct government aid. Four major carriers went bankrupt, and the industry shed more than 100,000 jobs, around 15 percent of its entire workforce.

The 50-seat regional jet played a key role in the industry’s recovery. Until about 1998, smaller airports were served either by larger jets, which were oversized for these markets, or turboprops, which flew slow and not as far. As the airlines attempted to stave off bankruptcy, they began buying a repurposed corporate jet manufactured by Bombardier, the CRJ200. The plane allowed the airlines to better match their smaller markets with demand, which in turn allowed them to redeploy larger planes to more lucrative international routes. The jets could also reach markets that were beyond the reach of the turboprops, allowing airport hubs to expand their customer base.

At first these planes were operated in house or through wholly owned subsidiaries, but after a time the flying was outsourced to independent companies. That strategy was initially constrained by the pilot unions, because collective-bargaining agreements typically limited how much flying could be outsourced.

A standard response emerged: If the unions refused to renegotiate their contracts, the airlines threatened to declare bankruptcy, where they might be judicially absolved from the commitments they had promised to workers. Forced to make concessions, the unions allowed more outsourcing to avoid options that would hurt their current members more, like additional layoffs or pay cuts. Because of these dynamics, every major airline had secured permission to fly more regional jets by the mid-2000s. As a result, regional jet capacity grew by 97 percent between 2000 and 2003, suddenly making these planes an integral part of the system.

Regional airline pilots and flight attendants have always made less than their mainline counterparts, but before 2000, the regional airline workforce was much smaller. In 1978, regional aircraft flew approximately 5 percent of all domestic departures; in 2000, 16 percent; in 2015, 45 percent.

Through outsourcing, the major carriers effectively introduced a permanent secondary scale. The result is that today’s young pilots are embarking on careers that look markedly different from the ones their senior colleagues began a generation ago. Though it’s still possible to make $200,000 flying international routes at a top airline, new pilots must now progress through a regional pay scale before they begin their ascent of a major’s scale, meaning it will take them longer to get to top pay, and their lifetime earnings will ultimately be lower. This helps explain why more than $100,000 in income now separates the top-earning 10 percent of pilots from the lowest-earning decile, a wage differential matched by few occupations.

Toward the latter half of the 2000s, consolidation played an equally important role in forcing down the pay of entry-level pilots. Though Congress intended for the Airline Deregulation Act of 1978 to promote competition, the four largest airlines now find themselves in control of 80 percent of the market. When the reform passed, five airlines controlled 70 percent of the market. This has helped awaken political interest in consumer rights, but less attention has been paid to how airlines could wield market power to depress wages.

In the midaughts, regionals often earned substantial profits, but as the majors struggled through bankruptcies and the 2008 recession, they sought to renegotiate the amount they were paying to the regional carriers, ultimately securing new agreements on much less generous terms. Several concurrent trends also caused the airlines to re-evaluate their reliance on 50-seat regional jets. Most significantly, jet fuel prices rose almost 500 percent between 2002 and 2008. When Bombardier released a larger, 76-seat version of the CRJ200 that had far superior fuel economy, there were suddenly powerful incentives for the airlines to find ways to get rid of their 50-seaters.

Market power made it easier for the airlines to achieve this goal. After the mergers between Delta and Northwest in 2008, United and Continental in 2010, and American and US Airways in 2013, each combined carrier found itself in control of a large fleet of undesirable 50-seat jets. The regionals, on the other hand, had fewer customers to whom they could sell their flying. The majors used their leverage, which resembles what economists call “monopsony power,” to continually bid down the price they paid to regionals.

Delta took an especially aggressive tack, suing three of its regional partners for what it alleged were performance issues, in each case withholding millions of dollars in payments it would have ordinarily owed. This helped force Mesa Airlines into bankruptcy, and all three carriers eventually consented to reworking their agreements with Delta. In the new agreements, Delta sought to pay less for its flying and to retire 50-seat aircraft.

Even as they continued to put downward pressure on regional airline wages, Delta and the other majors began to earn record profits. Under such conditions in an ordinary market, economists would have expected the majors to face pressure to raise wages (the majors have raised the pay of direct employees, to Wall Street’s occasional chagrin), but outsourcing and market power have positioned the companies to exclude certain workers from their gains.

Certainly, a case can be made that the government should have more closely scrutinized some of the mergers of the past decade. But current antitrust law prioritizes a consumer focus. Prior to deregulation, merger review would have concerned itself with employee welfare, but as currently practiced, questions about monopsony—when there is only one buyer, in this case of labor—still might have escaped the attention of a more vigilant merger review.

In the “hipster antitrust” corner of Twitter, some are arguing for a more expansive form of trustbusting, one that could mitigate the effects corporate concentration appears to be having on wages in certain parts of the economy, and as appears to be happening in the airline industry. It’s a policy solution that deserves more consideration, but one that might not be enough to arrest the fall of airline wages.

The airline industry has no formal minimum wage because the Fair Labor Standards Act exempts transportation workers. Because of that, unions are it—the de facto wage floor. The problem is that America’s uniquely permissive bankruptcy laws have undermined the strength of unions.

Pinnacle went bankrupt in 2012, a victim of a “race to the bottom” among the regional carriers, labor became the focus of attention, just as it does in all airline bankruptcies. A judge agreed that the company’s pilots were paid “substantially over market,” granting approval of a reorganization plan that included a 9 percent reduction in pilot pay, plus smaller cuts to flight attendant pay and employee benefits.

As an academic matter, bankruptcy law strives to treat all creditors as equals. But in its actual practice, the law has evolved to allow certain creditors to skip to the front of the line. When that allows one party to successfully evade its fair share of the losses, other parties, including labor, stand to lose more.

Plane financiers, in particular, enjoy special treatment through Section 1110 of the bankruptcy law, a provision that essentially bankruptcy-proofs an airplane, allowing lenders to reclaim an asset that might otherwise be sold in order to pay off other creditors. This protection is unique to the perennially insolvent airline industry and helps explain why the financial industry remains willing to lend it money.

This is a notable intervention into a supposedly “deregulated” industry, and without it the airline industry might require more direct forms of public subsidy. In the case of the regional airline industry, 1110 made it much easier for airlines to make consequence-free escapes from their leases after rising fuel costs made their 50-seat jets less economical.

Labor, conversely, cannot cut the creditor line, and the courts can discharge collective bargaining contracts and employee pensions just like any contractual obligation that isn’t an aircraft. The Supreme Court’s Bildisco decision required the airlines jump through some additional hoops before a judge can allow them to rip up a union contract, but the mere fact of its possibility weakens the bargaining power of unions by making companies less accountable to what they’ve promised workers. Accordingly, the rejection of labor contracts “has not been the mechanism of last resort to save a failing business,” the Air Line Pilots Association told Congress in 2010, “but instead has often been used by employers as a business model to gain long-term economic advantage by unfairly gutting the wages and working conditions of airline and other employees.”

Most other countries’ bankruptcy courts do not work this way. Canada does not let bankrupt companies tear up labor contracts. Some countries jail the executives of bankrupt companies while the boards of insolvent American operators often award “retention bonuses” to their executives. U.S. laws don’t even require bankrupt companies to prove they’re bankrupt, allowing a number of U.S. airlines to enter the process with healthy stores of cash. Of late, as the U.S. airlines have sought to prevent Middle Eastern carriers from securing permissions to serve more U.S. airports, they have pointed out various subsidies these airlines receive from their governments. In response, the Middle Eastern carriers have inventoried the ways in which Chapter 11 shelters U.S. airlines from the free market.

* * *

Even as the airlines have earned record profits in recent years, they’ve canceled or reduced service to cities across the country, quietly rendering a dramatic remapping of the national air transit system. Twenty-three percent of U.S. airports lost more than 20 percent of their flights between 2013 and 2016, and at least 18 airports lost service altogether, according to numbers provided by the Regional Airline Association. The airlines say this is simply the pilot shortage in action, but it’s more accurately understood as the ongoing legacy of the decision to deregulate the industry.

It’s always been tough to make a buck running an airline. In general, the fixed costs of operating any airplane are high, but bigger planes tend to have lower costs per passenger. We have airline hubs because very few pairs of cities are large enough to sustain a high frequency of service using large airplanes. The hubs allow airlines to assemble enough passengers to fill a larger plane, allowing them to profitably increase service between two cities. The academic and former airline executive Michael Levine, one of intellectual forefathers of deregulation, has described hubs as “factories [that] manufacture route density.”

Southwest and other low-cost airlines have famously scorned hubs. They operate as point-to-point operations, mostly flying lucrative routes between major cities, and only as often as they can fill an airplane. By comparison, operating hubs is considerably more expensive and complex. Hub operators—these days Delta, United, and American—have historically recouped these costs by operating as “everywhere to anywhere” airlines. Through the cross-subsidization of routes, consumers paid a premium to access a comprehensive network that could get them from Bemidji to Bamako.

In the first two decades after deregulation, there was enough competition and industry turmoil to inhibit the expansion of low-cost airlines like Southwest. But in the mid-’90s government regulators began to regard Southwest as a positive competitive influence on the hubbed airlines—whenever Southwest managed to enter a new market, fares fell. To promote the expansion of what became known as the “Southwest effect,” the government helped ensure that low-cost airlines were getting opportunities to service major airports.

As more low-cost airlines began competing on the lucrative routes between major cities, it was harder for the hubbed operators to charge the premium they required to recoup their higher operating costs. In short, the point-to-point business model was compromising the sustainability of the network model. That competitive pressure motivated the hubbed carriers to use outsourcing and the market power they acquired from consolidation to continue pushing regional wages down, even while they earned huge profits.

The pilot shortage is the limit of that strategy—pay got too low, so people stopped wanting to do the job. The airlines could try to charge more money to the passengers flying from smaller airports, but that has its own drawback—at some point those passengers will opt to begin their trip by driving to a larger city. Consolidation has also made it less essential for the hubbed airlines to worry about smaller markets. As the airlines consolidated, more traffic is being handled by the largest hubs. This means airlines don’t need to reach as deep into the country to fill a large plane that’s bound for Paris or New York. In some ways the hubbed airlines have become more like Southwest.

Essentially, we have made a consumer-welfare trade-off, swapping a more comprehensive system with somewhat higher fares for a more limited one that can deliver the best value on the country’s most popular flights. The winners of the trade-off are people who make frequent trips between New York and L.A. The losers live two hours outside of Memphis, or work entry-level jobs on the flights that would serve those communities.

This is a defensible policy trade-off. But as has often been the case in the years since deregulation, the changes we made to the air transit system didn’t happen after a vigorous public debate. We have continued to allow the market to sort it out, even as it becomes clearer that the market’s imperfections might prevent it from delivering a system that can satisfy all parts of the country. It’s also an approach that has continued to pass the expense of policy transformation on to employees. We should bear such costs in mind as we continue to demand lower and lower fares.